A Qualified employee stock purchase plan (ESPP) is an employer benefit in which employees can purchase company stock through payroll deductions. There are typically additional benefits, such as discounts on purchases. However, it’s more complex than it sounds. The tax rules associated with ESPPs may introduce unintended consequences, and there are always risks in owning your employer’s stock.

How Does an ESPP Work?

Here are the key terms you need to understand.

Offering period: When employees can sign up for the ESPP and set up their automatic payroll deductions. It can be three years at most, but it is typically three or six months.

Purchase date: At the purchase date, the company uses the funds to purchase shares at the discount rate. The shares are deposited in the employee’s name into a brokerage account.

Holding period: The holding period is when you hold your shares before selling them. With an ESPP, you must hold your shares for one year after the purchase date and two years after the initial offering date to get tax-advantaged rates.

The IRS limits employees’ annual purchase amount to $25,000. The discount offered lowers this amount: For example, if the purchase price discount were 15%, the purchase amount would be limited to $21,250. Speaking of the discount, the maximum allowable discount that can be offered is 15%.

Lookback period

The lookback period may be an additional benefit. If offered, your 15% discount is applied to the price of the first or last day of the offering period, whichever is lower.

For example, suppose the offering period ran from January 1 to March 31, and shares were $50 on January 1 and $60 on March 31. In that case, the lookback period allows you to purchase the shares at the $50 price on January 1. Your purchase would be $42.50 after receiving the 15% discount. You would already have a $17.50 gain.

The Risks and Benefits of ESPPs

ESPPs offer significant potential gains. Discounted stock prices translate into immediate gains. In addition, the company’s long-term growth may enhance the value of your shares, positioning you to build wealth over time. However, you must consider their circumstances to avoid unnecessary risk. As a concentrated position becomes increasingly extensive over time, you should weigh the risks associated with holding it and have a diversification plan.

If your company experiences a setback or its stock performs poorly, you could lose money, even after applying the discount. Your salary/benefits, purchasing stock in an ESPP, other stock options, and possibly owning stock in your 401k is the definition of putting all your eggs in one basket. When things are great, that’s outstanding; however, if your employer’s fortune turns south, it could be financially devastating.

ESPP Tax Rules

ESPPs can seem straightforward, but they can involve unexpected tax complexities. Determining the tax impact involves considering the purchase price discount and the holding period. To calculate taxes, you’ll need to know the price of your shares on several key dates.

- Offering date

- Purchase date

- Sale date

You will pay taxes on your Qualified ESPP shares only when you sell them. The amount of taxes you pay depends on whether it was a qualifying or nonqualifying disposition.

Qualifying Dispositions

Two rules govern whether ESPP shares are treated as a qualifying disposition.

- Shares must be sold at least one year from the purchase date.

- Shares must be sold at least two years from the offering date.

To qualify for the beneficial tax rates, both rules must be satisfied. You will have to pay ordinary income tax on the smaller amount between the discount offered on the offering date price or the difference between the purchase and sales prices. Any gain above the discount will be subject to long-term capital gains tax.

This is where the tax benefits are realized since long-term capital gains rates (See 2026 Chart below) are more favorable than ordinary income rates. However, you’ll have to hold on to the stock for at least 1 year to qualify for this better tax treatment.

Here’s an example of a qualifying disposition.

Offering date stock price: $100.00

Purchase Date stock: $110.00

Discount of 15%: $15.00

Number of shares: 200

Price Paid: $85.00 ($100.00 – $15.00)

Price Sold: $150.00

Let’s say your effective tax rate is 18%. Your effective tax rate is the percentage of your overall taxable income that you pay in taxes. It’s usually much less than your highest tax bracket rate. We’ll also assume you are in the 15% long-term capital gains tax bracket and have held the stock for more than 2 years after the offering date and 1 year after the purchase date.

Ordinary Income: $100.00 – $85.00 = $15.00 x 200 shares = $3,000.00

Ordinary Income Tax: .18 x $3,000.00 = $540.00

Long term capital gains: $150.00 – $100.00 = $50.00 x 200 shares = $10,000.00

Capital gains tax: .15 x $10,000.00 = $1,500.00

Total tax: $540 + $1,500 = $2,040

Disqualifying Dispositions

You will have a disqualifying disposition if you don’t meet the two rules mentioned above. In this case, you will be subject to ordinary income and capital gains taxes. In a disqualifying disposition, ordinary income tax will be calculated based on the difference between the purchase price and the stock price on the date you bought the stock. Gains or losses will be determined by the difference between the stock purchase price and the price when sold. The capital gain rate depends on whether the stock was held for a short or long-term period. Let’s consider another example using the same numbers from above. We’ll keep the same effective tax rate of 18% and 15% long-term capital gains rate. This time, however, you’ve held the stock for less than 2 years from the offering date but more than 1 year after the date of purchase.

Ordinary Income: $110.00 – $85.00 = $25.00 x 200 shares = $5,000.00

Ordinary Income Tax: .18 x $5,000.00 = $900.00

Long-term capital gains: $150.00 – $110.00 = $40.00 x 200 shares = $8,000

Capital gains tax: .15 x $8,000 = $1,200.00

Total tax: $2,100.00

To illustrate a scenario in which you owe short-term capital gains, let’s assume you’ve held the stock for less than 2 years from the offering date AND less than 1 year after the purchase date.

The ordinary income is the same, but since you held the stock less than one year after the purchase date…

Ordinary Income Tax: $900.00 (Same as the above example)

Short Term Gains Tax Owed: .18 x $8,000.00 = $1,440.00

Total tax: $2,340.00

Paying less tax with a qualifying disposition isn’t always the best option. For instance, it might not be wise to keep a significant amount of your employer’s stock for an extended period, especially if the company’s prospects are unfavorable. It could be worth taking the profits while you still can.

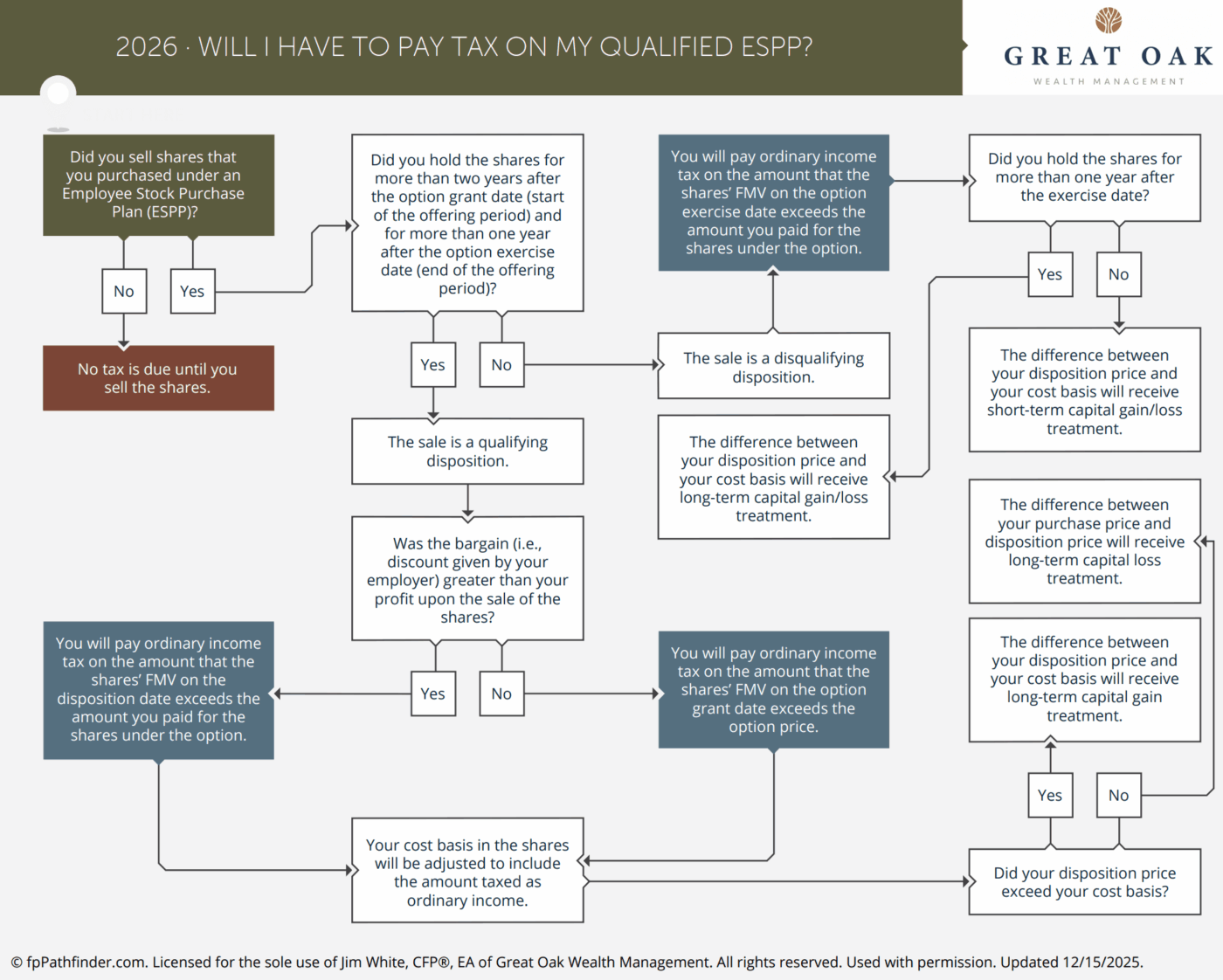

I know that was very confusing. We included a handy chart below to help you understand the tax ramifications a little more clearly.

ESPP Considerations

If you are participating in your employer’s ESPP or plan to do so, consider how it fits into your financial plan. You need to know how much you should contribute and the plan to sell the shares to keep taxes as low as possible. There is no one-size-fits-all strategy for achieving the best outcome. Your selling strategy may shift depending on your risk tolerance, liquidity needs, personal circumstances, and financial goals.

Bottom line

Whether you’re aiming to maximize tax advantages through qualifying dispositions or mitigate the tax consequences of disqualifying dispositions, a tailored approach is essential. Working with a financial advisor who can help you assess how participation in an ESPP may impact your overall financial plan. This can help you make more informed decisions about when to enroll in the plan, how much to contribute, when to sell your shares, and how ESPP tax rules might affect your after-tax proceeds.

We hope you enjoyed this post. If you’d like to read more, you might like to consider subscribing to our monthly newsletter. You can do so via the sign-up form below.