Investing involves assuming a certain amount of risk for the desired investment return. This acceptance of risk is called your risk profile and contains two parts. The first measures your risk-reward trade-off, your investment risk tolerance. The second determines your risk capacity – the amount of risk you can afford. Knowing your risk profile is essential in determining your investment sweet spot – peace of mind and long-term investment success.

Your risk profile aims to develop an appropriate asset allocation for your comfort level and situation – a percentage of your portfolio invested in various asset classes, such as stocks, bonds, alternatives, and cash. Allocating your assets among different investments creates diversification but never eliminates risk.

Part 1 – Investment Risk Tolerance

To determine your risk tolerance accurately, you must understand your reaction to economic conditions. We want to know what keeps you up at night. Can you sleep at night when the markets are going crazy? That’s what investment risk tolerance comes down to. The factors that influence risk tolerance include:

- Your age, current financial situation, and goals.

- Current economic climate: If we’re in a bear or a bull market, it will affect your risk comfort level.

- Your optimism or pessimism about the economy and your finances.

- Get a flat tire on the way to our meeting? Even how your day is going will affect your risk tolerance.

- How the questions are posed influences the responses. Are they positively or negatively worded questions?

Risk tolerance is broken into two steps: understanding your goals and measuring your risk comfort level.

Understand your goals

This series of questions maps out your investing timeline. Whether you need the funds in a year or twenty makes a big difference.

1. What goals do you have regarding your investments? It could be retirement, real estate, college tuition, or maybe all three.

2. What is your time horizon for your goals? When will you need the funds?

- One to three years

- Three to five years

- Five to ten years

- Ten years or more

3. What saving stage would you consider yourself?

- Early-Career: Saving just started

- Mid-Career: Balancing savings, mortgage, and other lifestyle expenses

- Late-Career: Ramping up savings, reducing debt, and making final preparations for retirement

- Retired: Not withdrawing savings yet

- Retired: Currently taking money out of the accounts

These questions specify the purpose, time horizon, and current life situation for when you will need the funds and how that relates to achieving your goals. These questions are really used as discussion points to delve further into your mindset to…

Determine your investment comfort level

Once we have your goals and desired timelines, we must understand your risk comfort level. There are many different ways to attempt to capture this measurement. There is no agreed-upon scientific method. The questions are more of an art form that has you consider or recall times of investment discomfort. Here is a sampling of some of the questions used at Great Oak.

1. From September 2008 through November 2008 and February 2020 through March 2020, stocks lost more than 31% of their value. If you owned an investment that lost 31% of its value quickly, you would…

- Sell all of the investment.

- Sell some of the investment.

- Hold the investment and sell nothing.

- Buy more.

2. I prefer an investment with minimal ups or downs in value, and I am willing to accept the lower returns these investments may make.

- Strongly disagree.

- Disagree.

- I somewhat agree.

- Agree.

- Strongly agree.

3. When the stock market drops, I prefer to sell some riskier investments and invest the money in safer investments.

- Strongly disagree.

- Disagree.

- I somewhat agree.

- Agree.

- Strongly agree.

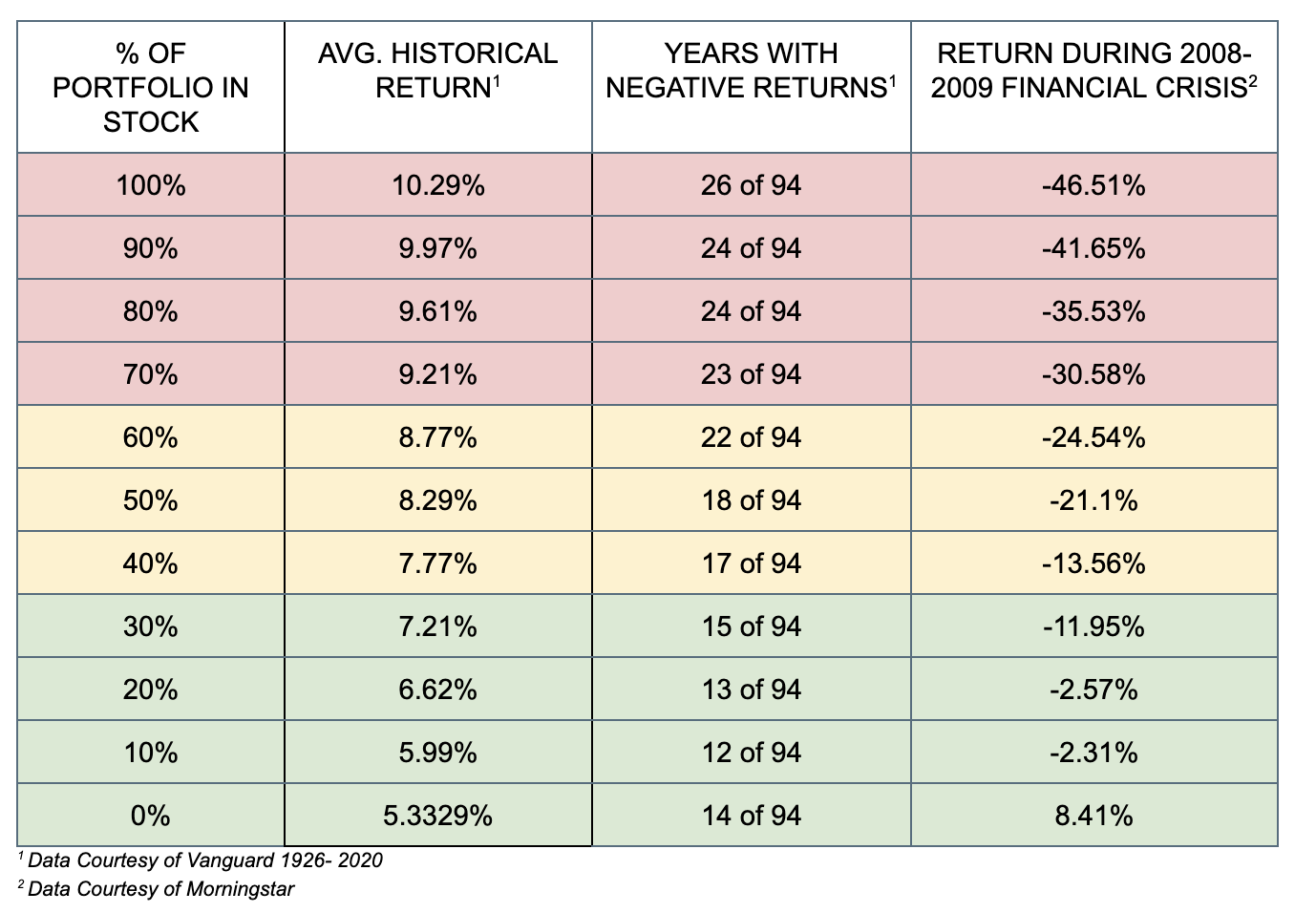

4. The chart below shows the average historical return, the number of years with negative returns, and the loss during the 2008 financial crisis. Given the possible gain or loss in any year, which portfolio allocation would you be comfortable investing in?

Listening to the investment risk tolerance reality

Finally, ongoing discussions are critical to measuring your risk tolerance. Listening to your concerns, thoughts, financial situations, and changes in your life – feelings and facts not captured in a questionnaire. We’ve been doing this for almost 20 years. We have used numerous questionnaires and software to capture your investment risk tolerance effectively. Whether we use 10 questions or 50 questions, paper and pencil, or an online survey, those tools are only essential and complete if used in conjunction with a discussion. Not just one time but whenever we discuss risk, return, and allocation. That is where meaningful decisions are made.

Part 2 – Understand your risk capacity

Understanding your investment risk tolerance is only one part of the equation. It is just as important to review your risk capacity. How much risk can you afford to take?

We’ve developed our own formula to determine your risk capacity. Originally only used for retirement planning, we are beta testing it for other goals, with some minor tweaks.

If you’re more than ten to fifteen years away from your need to use your saved funds or income, you can afford to be aggressive, and time allows you to have a higher risk capacity. However, once you begin to get closer to your goal, your risk capacity becomes more important.

There are 5 main factors we analyze

- Current age

- Savings rate

- The number of years and the annual amount required for the goal

- Amount of Liquid Assets to be used (401ks, IRAs, savings accounts, etc.)

- Current income and/or guaranteed income ( employment/self-employment earnings, Pensions, Social Security, etc.)

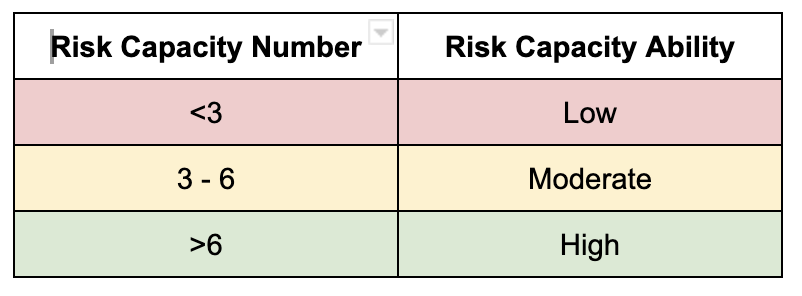

A score is generated after inputting the above information, placing you within the following range.

Risk Capacity Score:

We compare that to your investment risk tolerance to determine if it aligns with your ability to take risks. It goes both ways. You may be too aggressive in your risk compared to your ability to take it, or you may be much more conservative than you should be.

While I’m not going to reveal the secret sauce of the formula, it is not something that is always boiled down into a single equation. There are often additional variables or unique situations that may have to be considered. The equation is not the end-all-be-all final answer. Like investment risk tolerance, it is a guide for further discussion.

Final word

It is critical to note that your risk tolerance and capacity will evolve over time. It is not static. Measuring your risk profile regularly ensures that your investment portfolio aligns with your current financial situation. Getting all of your risk ducks in a row is essential in determining your investment sweet spot. Your peace of mind and long-term investment success comes from having the appropriate risk profile.

If you enjoyed this post, please feel free to share it. You can do this easily via any of the share buttons below.