The distribution options available to the beneficiary of an IRA are confusing. Spouse vs. non-spouse. Is the beneficiary 59½? Had the account owner begun Required Minimum Distributions? Are you an Eligible Designated Beneficiary (EBD)? Trying to put it all together to determine which inherited IRA option is available and best for your situation is enough to drive you crazy. It is, however, essential to get it right. The financial implications and tax consequences could be significant.

Untangling the inherited IRA

When you inherit an IRA, your situation dictates how many of the five possible inherited IRA options are available to you.

- Disclaim the IRA

- 5-year Inherited IRA

- Treat As Your Own

- 10-year Inherited IRA

- Stretch IRA

Disclaiming the IRA: A beneficiary is allowed to refuse an IRA. Yes, disclaiming is a thing, and it just might be in your best interest. When you disclaim an IRA, it goes to the next beneficiary in line; you don’t get to dictate who gets it. This decision should not be taken lightly. There are rules, repercussions, and traps. Read Thanks, But No Thanks! How To Refuse An Inheritance By Disclaiming to learn how to disclaim an inheritance (IRA or otherwise). If you disclaim it, the next beneficiary in line can determine their Inherited IRA options.

5-year Inherited IRA: The 5-year rule for inherited IRAs generally applies in the following situations:

- For non-designated beneficiaries (e.g., estates or charities) who inherit an IRA from an owner who died before reaching their Required Beginning Date (RBD) for Required Minimum Distributions (RMDs).

- For Roth IRAs, if the original account holder died before the Roth IRA was held for five years. In this case, earnings withdrawn by the beneficiary within five years of the original owner’s first Roth IRA contribution may be subject to taxes.

- As an option for some beneficiaries who inherited an IRA before January 1, 2020, these beneficiaries could choose to distribute the entire account balance within five years of the original owner’s death.

Treat As Your Own: This is only available to a surviving spouse. The spouse can make the IRA their own by either re-titling it in their name or rolling the money, tax-free, into an existing IRA or 401k.

10-year Inherited IRA: The designated beneficiaries create an inherited IRA and must distribute the entire IRA within ten years. Initially, there was no set schedule. The beneficiary can take distributions all in the first year, all during the 10th year, over multiple years, or anytime in between. The IRS has decided to rain on everyone’s parade and has ruled that there must be annual distributions. The account must still be fully depleted within ten years. We expect some further guidance on this inconsistency.

Stretch IRA: The stretch IRA only applies to the following Eligible Designated Beneficiaries (EBDs),

- Spouses

- Beneficiaries who are no more than ten years younger or older than the deceased owner of the IRA

- Disabled or Chronically ill beneficiaries

- Minor Children but only until they reach the age of majority, which is between 18 and 21, depending on your state. Once they reach the age of majority, the 10-year Inherited IRA goes into effect, and they have ten years from the age of majority to distribute the entire IRA.

Depending on the situation, those beneficiaries are allowed to implement the stretch spread annual distributions over either the deceased owner’s life expectancy or the beneficiary’s single life expectancy.

Which inherited IRA option is available to you?

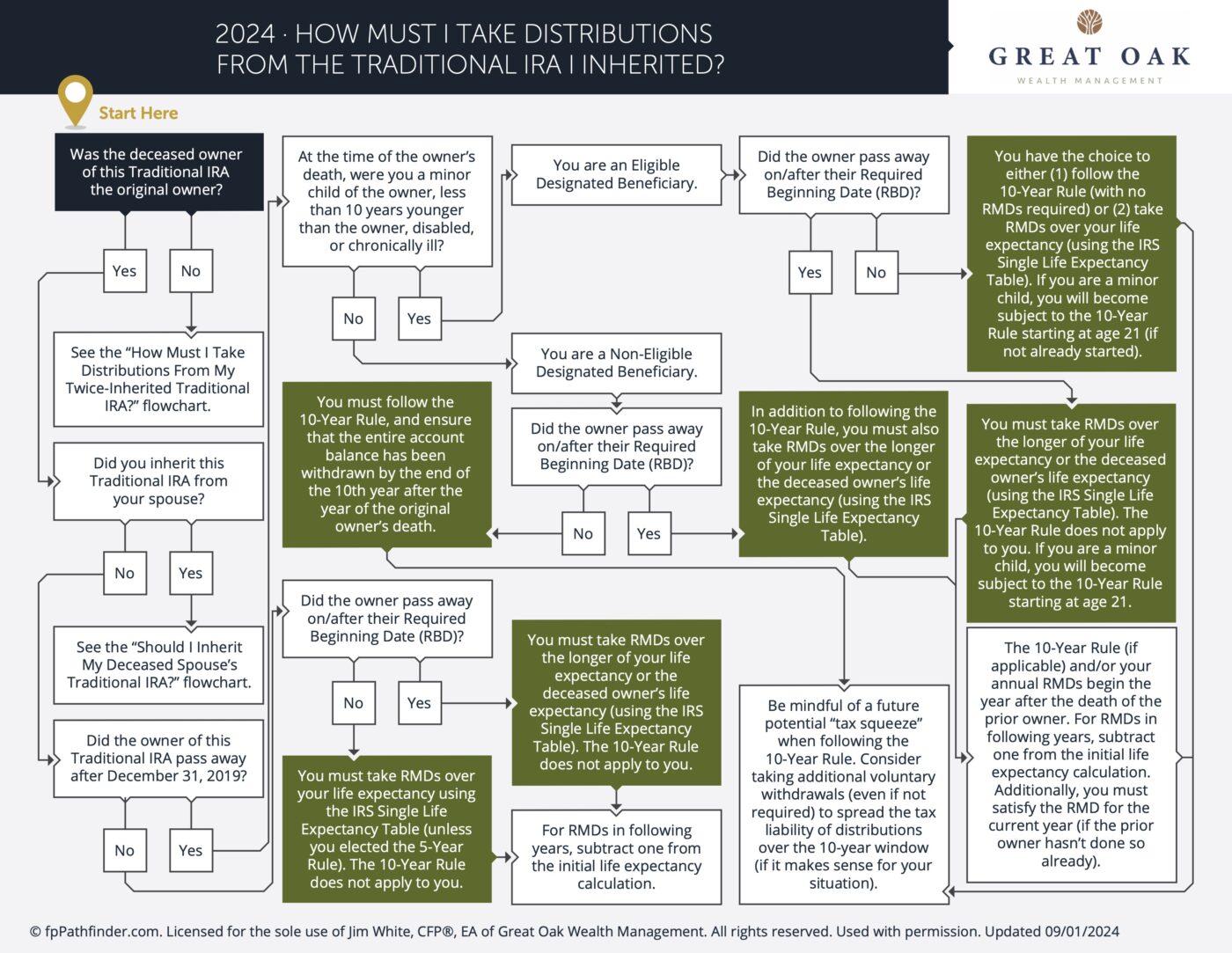

Let’s begin putting all of this together. To make it easier, here’s a handy flowchart.

You now understand the options available and when, but that’s only the first step. The second step is determining which one of those options is best for you. That, of course, depends on your needs.

Time-Out #1 Inherited IRA Taxability

Traditional Inherited IRA (5-year Inherited, 10-year Inherited, Stretch): All distributions are taxable as income, and there is no early distribution penalty, regardless of age.

Traditional Inherited IRA (Treat As Your Own): This option only applies to the surviving spouse. All distributions are taxable as income. However, a 10% early distribution penalty applies if you Treat it as your own, take distributions, and you’re younger than 59½. (Hint, Hint)

Inherited Roth IRA (all options): You can always withdraw contributions tax-free from an inherited Roth IRA. The withdrawal of earnings is tax-free as long as five years have passed since the owner made their first Roth contribution. Please note the 5-year clock starts on January 1 of the year of the first contribution. Otherwise, earnings withdrawn are taxable. There is no 10% penalty, however, regardless of age. Once the 5-year time limit has expired, all distributions are tax-free. So it isn’t a permanent condition. Also, due to the withdrawal order, earnings come out after contributions.

Show me the money

Whether it’s an inherited Roth or traditional IRA, or if you’re the spouse, here are some common scenarios to help you understand your options.

Spousal beneficiary inherited traditional IRA

Which one is appropriate, a Stretch IRA or Treat As Your Own IRA depends on four factors.

- Age of surviving spouse – over/under 59½

- Age of deceased spouse at passing – over/under 73

- The age difference between spouses and which one was older

- The need, if any, to withdraw funds

Let’s be honest here. Having to consider four factors to determine which option is appropriate makes things a tad bit complicated.

Surviving Spouse under age 59½

If no withdrawals are needed neither presently nor until after you’ve reached 59½, then Treat As Your Own. Re-title it under your name or transfer it to an IRA you already have open.

If withdrawals are needed, create a Stretch IRA. Doing so will allow you to take distributions without the 10% early distribution penalty.

The point is you don’t want to incur the 10% penalty you would be subject to if you Treated the IRA As Your Own and took distributions when you were younger than 59½.

Had the deceased spouse reached age 73 at the time of passing?

No, the deceased spouse passed away before reaching age 73

Stretch IRA: Distributions must begin no later than 12/31 of the year the deceased would have reached 73. The distributions are calculated using the surviving spouse’s Single Life Expectancy Table.

Yes, the deceased spouse passed away after reaching age 73

Stretch IRA: You must begin taking annual distributions no later than 12/31 of the year after the original owner’s death. Distributions are calculated using either the surviving spouse’s life expectancy or the deceased owners’ remaining life expectancy, whichever is longer. Both are based on the Single Life Expectancy Table.

Any situation

Treat As Your Own: When you make it your own, regardless of whether your spouse reached 73 or not, distributions are required when you reach 73.

Spousal bonus!

Yes, a spouse inheriting an IRA can create a Stretch IRA and then, at a later time, change to Treat As Your Own. If the surviving spouse is under 59½ and needs funds, they can establish a Stretch IRA to withdraw funds, avoiding the 10% penalty. Anytime after they reach age 59½, they can Treat As Their Own. That lets them defer any further withdrawals until they reach 73 if they so choose.

On the other hand, they could keep the Stretch IRA and delay distributions until their spouse would have turned 73, then do a Treat as their own, like the example above. Please note you can’t Treat As Your Own and then change your mind and make it a Stretch IRA. A spouse can only move it from a Stretch IRA to a Treat As Your Own.

A spousal beneficiary traditional IRA is confusing and complicated, especially regarding the spouses’ ages. Analyzing when to Treat as Your Own versus creating a Stretch IRA requires analysis. It’s already a difficult time for the surviving spouse. Figuring out which of the myriad of potential scenarios makes financial sense is challenging.

Spousal beneficiary Roth IRA

Spouse younger than 59½

Like an inherited traditional IRA, if no withdrawals are needed presently or until after you’ve reached 59½, then Treat As Your Own. If withdrawals are required, create a Stretch IRA. Doing so will allow you to take distributions without incurring the 10% early distribution penalty, which you would be subject to if Treat As Your Own and took distributions. Reminder, don’t forget about the 5-year Roth Rule! Once you reach 59½, you can use the spousal bonus and Treat As Your Own.

All other scenarios

For everyone else, it rarely pays to create a Stretch Roth IRA as a spouse. The reason? Unlike traditional IRAs, Roth IRAs do not require distributions when the owner reaches age 73. However, inherited Roth IRAs do. Distributions based on the beneficiary’s Single Life Table are required to begin when the deceased spouse would have attained the age of 73.

As a spouse, if you’re over 59½, whether you need the funds or not, the best move is to Treat As Your Own to eliminate the potential need to make required withdrawals.

Non-spousal beneficiary options

Determining how to proceed with a non-spousal inheritance of an IRA is straightforward compared to the spousal inheritance (refer to Flowchart). That’s because there is no Treat As Your Own option. That leaves the 10-year Inherited IRA, or the non-spousal Stretch IRA if there is less than a 10-year age difference between the beneficiary and deceased.

Inherited IRA – get some help

I couldn’t cover every scenario, but I wanted to provide general guidelines for the options available, the decisions to be made, and the results to expect when you’re the beneficiary of either a Traditional or Roth IRA. Inherited IRAs can have significant financial and tax implications. Please contact your CERTIFIED FINANCIAL PLANNER™ professional to determine what option is in your best interest when you inherit an IRA.

Now you know the options, but the rules are just as important. Continue to expand your inherited IRA knowledge and read The 8 Inherited IRA rules to know before it’s too late.